Unauthorized Credit Card Charge: How to Detect and Prevent Fraud

Introduction

In today’s fast-paced digital world, financial fraud is a growing concern. One particularly alarming threat is the unauthorized credit card charge. In this scenario, Omar discovers an unfamiliar charge on his credit card statement—a charge he never authorized. This unexpected transaction sets off a chain reaction of concern, prompting him to take immediate action. The focus of this article is to help you understand how to identify and deal with an unauthorized credit card charge, as well as how to safeguard your financial information against such scams.

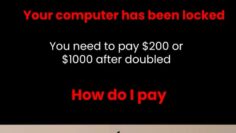

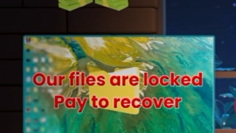

Understanding the Unauthorized Credit Card Charge Scam

An unauthorized credit card charge occurs when someone fraudulently uses your card details to make a purchase without your permission. In our scenario, Omar questions, “I don’t remember making this purchase. Could someone have stolen my card details?” His colleague Adam advises him to contact his bank immediately, while Sarah suggests checking for smaller test charges—a common tactic used by scammers. These small, unauthorized transactions are meant to verify that the card is active before larger amounts are charged. This scenario is a classic example of how fraudsters exploit our trust and often use subtle methods to commit financial fraud.

Warning Signs of an Unauthorized Credit Card Charge

There are several red flags that might indicate an unauthorized credit card charge. One major warning sign is the appearance of unfamiliar transactions on your statement. Even if the amounts are small, these charges are often a precursor to more significant fraud. In Omar’s case, the sudden charge caught him off guard, leading to immediate suspicion. Other signs include unexpected notifications from your bank or sudden changes in your spending patterns. Recognizing these early warning signs can be crucial in preventing further unauthorized activity on your account.

Immediate Steps to Take When You Encounter an Unauthorized Credit Card Charge

If you detect an unauthorized credit card charge, time is of the essence. The first step is to contact your bank or card issuer immediately. Inform them about the suspicious charge and ask them to investigate the transaction. Omar’s prompt decision to contact his bank prevented further unauthorized purchases. Additionally, review your recent transactions carefully—scammers sometimes make several small charges before making a larger fraudulent purchase. Activating transaction alerts is another effective method to ensure you are immediately informed of any future activity on your account. Acting quickly can make the difference between stopping fraud in its tracks and suffering significant financial loss.

Best Practices for Preventing Unauthorized Credit Card Charge Fraud

Prevention is always better than cure. To protect yourself from unauthorized credit card charges, start by monitoring your account regularly. Make it a habit to review your statements and digital transaction history frequently. Another important measure is to activate alerts through your bank’s online system, which can notify you of any unusual activity immediately. Additionally, consider using virtual card numbers for online transactions, which can limit the exposure of your actual card details. Keeping your personal information secure, using strong passwords, and ensuring your devices are protected with updated antivirus software also contribute significantly to preventing such fraud.

Monitoring Your Financial Accounts to Prevent Unauthorized Credit Card Charges

Regular monitoring of your financial accounts is a powerful defense against unauthorized credit card charge scams. In Omar’s scenario, the discovery of an unfamiliar charge triggered a series of recommended actions. By routinely checking your credit card statements and online banking activity, you can quickly identify any discrepancies. Setting up mobile alerts for transactions is an effective way to stay informed in real time. These measures not only help in catching fraudulent charges early but also provide you with the necessary evidence to report the incident to your bank, making it easier to reverse the charges and secure your account.

Consumer Awareness and Education on Unauthorized Credit Card Charge Scams

Education plays a vital role in preventing financial fraud. Consumers need to be aware of the tactics employed by scammers, such as making small test charges or using sophisticated phishing methods to acquire card details. Informing yourself about the common signs of fraud and familiarizing yourself with your bank’s policies on unauthorized transactions can significantly reduce your risk. In the scenario discussed, Sarah’s advice to look for smaller unauthorized charges before larger ones highlights a key point: fraudsters often test your card to ensure it is active before they attempt more substantial charges. Being proactive and informed is the best defense against these scams.

Conclusion: Staying Safe from Unauthorized Credit Card Charge Fraud

Unauthorized credit card charge scams can strike suddenly and cause significant financial distress if not dealt with promptly. By understanding the tactics used by fraudsters and recognizing the warning signs, you can take swift action to protect your financial information. If you notice any suspicious activity on your account, contact your bank immediately and follow the recommended steps to secure your card. Regular monitoring, proactive alerts, and informed consumer behavior are all critical components in the fight against financial fraud.

Final Thoughts on Preventing Unauthorized Credit Card Charge Scams

The scenario involving Omar is a clear reminder of the importance of vigilance when it comes to managing your finances. Unauthorized credit card charges are not only an inconvenience but can also lead to substantial financial loss if left unchecked. Implementing best practices such as monitoring your accounts, setting up transaction alerts, and educating yourself about the methods employed by scammers will go a long way in safeguarding your financial future. Remember, the key to preventing unauthorized credit card charge fraud lies in early detection and rapid response. By staying informed and taking proactive steps, you can significantly reduce your risk and keep your financial information secure.

.png)